Fixed Annuities

Insurance contracts guaranteeing your principal investment and interest earned

Fixed Annuities are insurance policies that historically have been used to pay guaranteed retirement income for a certain period or for lifetime. Annuity contracts trace their roots back to Roman times when they were named annui, a Latin word meaning yearly payments or annual stipend.

Annuities have evolved over time from annui into tax favored instruments used for investment growth, while continuing to include traditional guaranteed payment options. Converting the accumulated value of an annuity into a guaranteed income stream is known as Annuitization; and when the lifetime payment option is chosen, it helps to provide a financial safety net for the rest of your life.

Policies that begin periodic payouts immediately following purchase are called Immediate Annuities, while policies purchased for growth and potential Annuitization later are called Deferred Annuities.

Annuities, along with life insurance, provide peace of mind knowing funds will be there when needed.

Are Fixed Annuities a suitable investment?

First, it should be noted that Fixed Annuities are fundamentally different from Variable Annuities, which can either lose or grow in value based on performance of the underlying investment choices. Sales agents that offer Variable Annuities must have a securities license in addition to their insurance license.

Fixed Annuities offer contractual guarantees of principal and interest earned, so they tend to be suitable for people seeking safety as well as investment growth. Prior to purchase, a complete suitability check and needs review should be conducted. Purchasers should consider their asset and income levels, possible need to diversify existing assets, future liquidity needs, and specific goals of a new annuity.

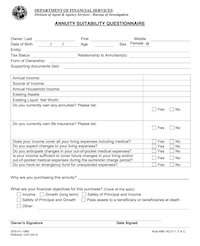

By law, all applications for Fixed Annuities must include a completed Suitability Questionnaire.

Fixed Annuities designed for investment growth have many advantages including:

- Principal and interest credited are contractually guaranteed not to lose value

- Funding can be from after-tax money or through a "rollover" of Qualified funds without tax consequence (many annuities accept existing 401K plans, Traditional IRAs, and Roth IRAs)

- Tax deferral of credited interest accelerates growth through "triple-compounding", which includes earning interest on the principal, interest on interest, and interest on what would have gone to taxes

- Annuities linked to upside performance in an equity index are available (these types of policies offer a greater potential for growth while still providing full protection from loss if the index value declines)

- Deferred Annuity purchasers can select a specific design to target Accumulation or Guaranteed Income

- In addition to deferring taxes on interest gains while your investment grows, annuities designed for Long Term Care (LTC) protection are allowed to make distributions for Qualified LTC expenses tax-free

What are the most common types of Fixed Deferred Annuities?

Multi-Year Guaranteed Annuities (MYGAs) feature a contractually guaranteed interest rate for a fixed period such as three years or five years. Interest earnings are credited at that rate and grow fully tax deferred. Surrender Charges (fees) are assessed for early termination; however, most MYGAs allow penalty-free withdrawals throughout the guarantee period. Such withdrawals may be limited to certain thresholds such as: 5% of account value each year, accumulated interest earned, Required Minimum Distributions (RMDs on Traditional IRA contracts), or other terms as specified in the contract.

Fixed Indexed Annuities (FIAs), like MYGAs, guarantee your principal and interest earned and accumulate the interest tax deferred. FIAs typically are designed for a longer time horizon compared to MYGAs, and they allow performance to be linked to an equity index such as the Standard and Poor's 500 Index (S&P 500). Unlike direct investment in securities, FIAs are protected against losses. In exchange, only a portion of Index growth is credited when the Index increases. Index measurement for interest crediting purposes often is on a one-year point-to-point basis with an annual reset for the next year.

Like MYGA contracts, FIAs include a surrender charge period during which penalties apply for full surrender of the contract (exceptions are made for partial withdrawals and other circumstances).

When choosing either a MYGA or FIA, it is important to review all terms including how funds are disbursed if the Annuitant (person insured by the Annuity) dies before the end of the planning horizon. Many policies pay a death benefit equal to the full account value without any surrender charge.

Taxation of Annuities

Regarding annuity taxation, when money is withdrawn the gains are taxed first prior to return of principal. Due to the tax deferred treatment of annuities, you won't pay taxes on any interest until you receive funds in the form of withdrawals, income payments, or as a death benefit. It should be noted that Qualified annuities funded by Traditional/Roth IRAs follow the tax treatment of that vehicle.

For people who are under age 59 ½, withdrawals from an Annuity may be assessed a 10% federal tax penalty applicable only to the taxable portion of the withdrawal.

Investment Time Horizon

When purchasing a Deferred Annuity, it is important to match the investment time horizon to the duration of the contractual surrender charge period. For FIA contracts, the length of the surrender charge period can be just a few years, or much longer up to 16 years. As the horizon comes to an end, the investor may choose to take advantage of tax laws that allow rollover into a new annuity (a 1035 exchange). Other options include annuitizing, taking a full distribution, or keeping funds in the contract.

Choose a Strong Insurance Company

Fixed Annuities are not backed by the federal government; therefore, it is always a wise idea to research the strength of the issuing company. You can check the financial strength and stability ratings given by ratings companies such as A.M. Best, Moody's and Standard & Poor's).

Further information on Fixed Annuities may be found by clicking on the links below. If you would like a consultation or a product illustration, please Contact Us or Request a Custom Quote.

Back to Top | Back to Fixed Annuities Home

Serving all of Tampa Bay

Click here to request a Personalized Insurance Quote!

AH Insurance Services, Inc.

3015 N Rocky Point Dr E #319

Tampa, FL 33607

Phone: (727) 743-4532

Fax: (727) 231-0736

Email:

By calling one of these numbers or mailing to the above addresses, I understand I will be directed to a licensed insurance sales agent or broker.

Y0070_NA030737_WCM_WEB_ENG_02 CMS Approved 02/16/2016

WellCare (HMO) is a Medicare Advantage organization with a Medicare contract. Enrollment in WellCare (HMO) depends on contract renewal.

Last Updated: 01/04/2026